E-commerce Payment Processing Trends: The Rise of Wallets and BNPL vs. Traditional Cards

Introduction:

The e-commerce landscape is evolving rapidly, and the way we pay for goods and services online is changing just as quickly. Traditional credit and debit cards have long been the dominant form of e-commerce payment processing for online purchases, but new trends are emerging that are challenging their reign.

In this blog post, we will discuss two of the most important trends in e-commerce payment processing: the rise of digital wallets and buy now, pay later (BNPL) options and compare with traditional cards. We will explore the factors driving the growth of these trends, as well as the potential benefits and challenges they present for both consumers and businesses.

Seeking a web developer for your e-commerce store? We’re here to seamlessly transition your business into the digital world with tailored expertise. Elevate your online presence with us

The Rise of Digital Wallets in E-commerce Payment Processing:

Digital wallets are mobile apps that store payment information, such as credit card numbers and bank account details. They allow users to make payments online and in-store without having to carry their physical cards. Digital wallets are becoming increasingly popular, thanks to their convenience and security.

There are a number of factors driving the growth of digital wallets. One factor is the increasing popularity of smartphones. As more and more people use smartphones for everyday tasks, such as shopping and banking, it is natural that they would also use them for making payments.

Another factor driving the growth of digital wallets is the increasing concern about online security. Digital wallets offer a more secure way to pay online than traditional credit cards, as they store payment information in a secure enclave on the user’s device.

The benefits of using digital wallets for consumers include:

- Convenience: Digital wallets are more convenient to use than traditional credit cards, as they eliminate the need to carry physical cards.

- Security: Digital wallets offer a more secure way to pay online than traditional credit cards.

- Rewards: Many digital wallets offer rewards programs that can help users save money on their purchases.

The benefits of using digital wallets for businesses include:

- Increased conversion rates: Digital wallets can help to increase conversion rates by making it easier for customers to checkout.

- Reduced fraud: Digital wallets can help to reduce fraud by making it more difficult for criminals to steal payment information.

- Improved customer data: Digital wallets can provide businesses with valuable customer data that can be used to improve marketing and customer service.

The Rise of BNPL in E-commerce Payment Processing

BNPL (Buy now, pay later) is a payment option that allows consumers to make purchases without having to pay the full amount upfront. Instead, consumers make a small down payment at the time of purchase and then pay the remaining balance in installments over a period of time.

BNPL (Buy now, pay later ) is becoming increasingly popular, particularly among younger generations. There are a number of factors driving the growth of BNPL, including:

- The increasing cost of goods and services: BNPL can make it easier for consumers to afford large purchases.

- The rise of online shopping: BNPL is particularly well-suited for online shopping, as it allows consumers to make purchases without having to enter their credit card information.

- The popularity of influencer marketing: Many BNPL providers have partnered with influencers to promote their products and services.

The benefits of using BNPL for consumers include:

- Affordability: BNPL can make it easier for consumers to afford large purchases.

- Convenience: BNPL is a convenient way to pay for online purchases.

- Flexibility: BNPL allows consumers to spread out their payments over a period of time.

The benefits of using BNPL for businesses include:

- Increased sales: BNPL can help to increase sales by making it easier for customers to afford large purchases.

- Improved customer satisfaction: BNPL can help to improve customer satisfaction by making it easier for customers to budget for their purchases.

- Reduced cart abandonment: BNPL can help to reduce cart abandonment by making it easier for customers to checkout.

The Enduring Presence of Traditional Cards:

Credit and debit cards have long been the workhorses of online payments, offering familiarity, ease of use, and widespread acceptance. Consumers appreciate the convenience of one-click checkouts and established fraud protection mechanisms. Businesses benefit from the security and reliability of card networks, along with guaranteed payment upon transaction completion.

The Complex Evolving Landscape:

The emergence of digital wallets and BNPL doesn’t signal the demise of traditional cards. Instead, it’s creating a dynamic interplay between established and new methods. Here’s how:

- Convenience vs. Security: Digital wallets offer frictionless payment experiences, while cards prioritize security through established verification protocols.

- Flexibility vs. Control: BNPL provides financial flexibility for consumers, but traditional cards offer greater control over spending due to immediate debits or clear monthly statements.

- Target Audience: Digital wallets and BNPL appeal to younger, tech-savvy demographics, while cards maintain a broader user base across all age groups.

The Future: Coexistence and Competition:

The future of e-commerce payments likely won’t be dominated by a single method. Instead, we can expect:

- Coexistence: Traditional cards will continue to play a significant role, particularly for larger purchases or in situations where instant payment is preferred.

- Competition: Digital wallets and BNPL will continue to innovate and improve their offerings, potentially chipping away at card market share.

- Personalization: Consumers will increasingly choose payment methods based on specific needs and preferences for each purchase.

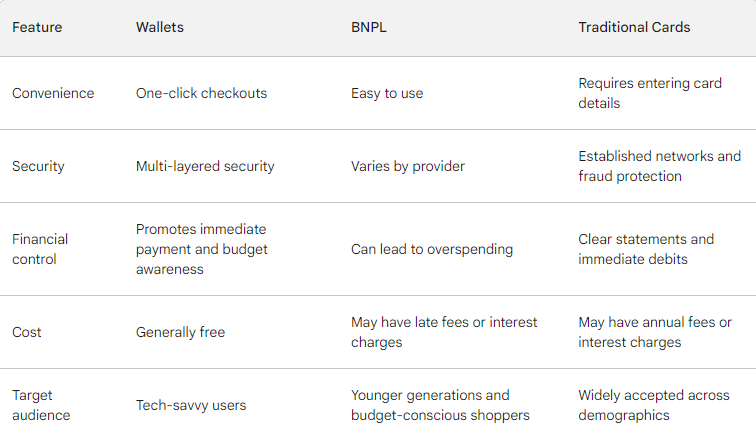

Wallets vs. BNPL vs. Traditional Cards: A Payment Showdown

The realm of online payments is a battleground, and the contenders are diverse: digital wallets, Buy Now, Pay Later (BNPL) options, and the ever-present traditional cards. Each method boasts its own set of advantages and drawbacks, making the choice for consumers and businesses alike a strategic one. Let’s dive into the ring and compare these payment gladiators:

Convenience:

- Wallets: Frictionless one-click checkouts reign supreme, with stored credentials eliminating the need for manual card entry.

- BNPL: Similar ease of use, often integrated seamlessly into checkout processes.

- Traditional Cards: While convenient, require entering card details for each transaction, potentially slowing down the checkout flow.

Security:

- Wallets: Offer multi-layered security, including biometrics and tokenization, protecting sensitive card information.

- BNPL: Security varies depending on the provider, but often relies on traditional credit checks and fraud detection measures.

- Traditional Cards: Established networks and fraud protection mechanisms provide solid security, but data breaches can still occur.

Financial Control:

- Wallets: Primarily linked to existing bank accounts or pre-loaded funds, promoting immediate payment and budget awareness.

- BNPL: Can blur budget lines with installment plans, potentially leading to overspending or debt.

- Traditional Cards: Offer clear statements and immediate debits, encouraging responsible spending habits.

Cost:

- Wallets: Generally free for basic use, though some may have transaction fees or subscriptions for premium features.

- BNPL: Often incur late fees or interest charges if payments are missed, adding to the total cost.

- Traditional Cards: May have annual fees or interest charges depending on the card type, but typically straightforward pricing.

Target Audience:

- Wallets: Appeal to tech-savvy users who prioritize convenience and security.

- BNPL: Popular among younger generations and budget-conscious shoppers.

- Traditional Cards: Widely accepted across demographics, preferred by those seeking established networks and familiar payment experiences.

The Verdict:

There’s no clear victor in this payment war. The “best” method depends on individual needs and preferences. Consider these factors when making your choice:

- Frequent online shopper? Wallets’ one-click checkout might be your champion.

- Need financial flexibility? BNPL can offer breathing room, but prioritize responsible repayment.

- Value security and established systems? Traditional cards remain a reliable choice.

Ultimately, the ideal payment landscape embraces diversity. Businesses that offer a mix of options cater to a wider customer base and optimize their checkout experience. As technology evolves, expect even more innovative payment methods to enter the arena, keeping the online payment scene exciting and dynamic.

Conclusion:

Traditional credit and debit cards have long been the dominant form of payment for online purchases, but new trends are emerging that are challenging their reign.

- Digital wallets are mobile apps that store payment information, such as credit card numbers and bank account details. They allow users to make payments online and in-store without having to carry their physical cards. Digital wallets are becoming increasingly popular, thanks to their convenience and security.

- Buy now, pay later (BNPL) is a payment option that allows consumers to make purchases without having to pay the full amount upfront. Instead, consumers make a small down payment at the time of purchase and then pay the remaining balance in installments over a period of time. BNPL is becoming increasingly popular, particularly among younger generations.

The rise of digital wallets and BNPL is not without its challenges. For example, some consumers may be concerned about the security of their financial information when using these methods. Additionally, BNPL can lead to overspending if consumers are not careful.

Overall, the future of e-commerce payment processing is likely to be dominated by a variety of methods, as consumers and businesses look for the most convenient and secure way to pay for goods and services online.

Here is a table that summarizes the comparison of wallets, BNPL, and traditional cards:

Jhon

28 December 2023very useful information

aeroslim reviews

9 March 2024I do believe all the ideas youve presented for your post They are really convincing and will certainly work Nonetheless the posts are too short for novices May just you please lengthen them a little from subsequent time Thanks for the post